Married Joint - Separate Comparison

This worksheet is only available for 1040 returns.

Use the Married Joint - Separate Comparison worksheet to see whether a married couple will benefit more from filing jointly or separately.

To use the Married Joint - Separate Comparison worksheet:

- Open your clients' return.

- Click the Forms menu, expand the Planning/Analysis fly-out menu, and then select Married Joint/Separate Comparison.

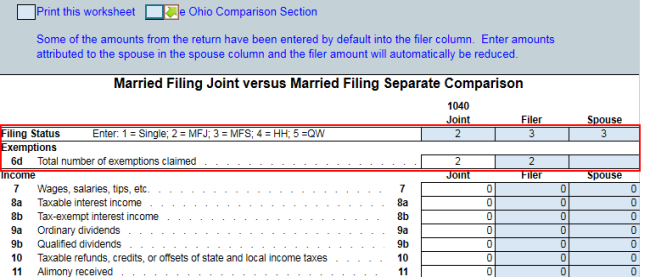

Married Joint - Separate Comparison worksheet (top)

- At the top of the columns, be sure the Filing Status and Exemptions are correct.

- Review the amounts in each of the Joint, Filer, and Spouse columns. Make adjustments, if required.

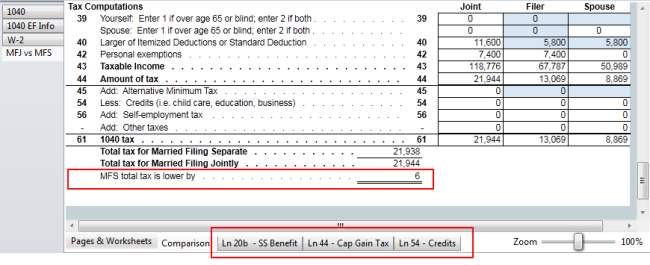

- Scroll to the bottom of the form to see the difference between Married Filing Separate and Married Filing Jointly:

Married Joint - Separate Comparison worksheet (bottom)

- Click the worksheet tabs at the bottom of the return to see the source for Social Security Benefits, Capital Gains (Schedule D), and Credits.

You can also add this worksheet to a return from the Select Forms Dialog Box. See Adding Forms to a Return.

See Also: